How to conduct market research to successfully trade cryptocurrencies

The world of cryptocurrency has developed exponentially in recent years, and many new investors enter the market every day. While some people make significant cryptocurrencies trading profits, others lose savings due to bad decision making and lack of knowledge. In this article, we will discuss how to conduct market research for successful cryptocurrency trading.

why market research is crucial

Before you start trading cryptocurrencies, it is necessary to understand the market on which you operate. Market research helps to make conscious decisions about investing your money, what to trade and how to avoid potential pitfalls. Here are some reasons why market research is crucial for successful cryptocurrency trading:

1.

- Identify areas with high height : Market research can help find areas with significant growth potential, such as new technologies or innovative products.

3.

4.

Types of market research

There are several types of market research that can be used for cryptocurrency trading:

- Technical analysis (TA) : This includes an analysis of charts and price movements to predict future trends.

- Basic analysis : This includes a study of basic economic indicators, such as GDP growth, interest rates and inflation rates.

3.

Sources of market research

There are several sources that can be used for market research in cryptocurrency trading:

- Message websites

: websites such as Cindesk, Cryptoslat and Cointelegraph provide current messages and analyzes on the cryptocurrency market.

- Financial information agencies : Agencies such as Bloomberg and Reuters offer real -time data and analyzes on a global economy and financial markets.

3.

4.

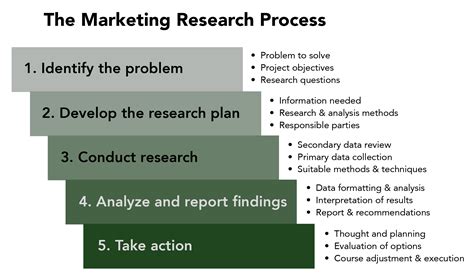

how to conduct market research

Here is a step -by -step guide on how to conduct market research for successful cryptocurrency trading:

- Choose your investment goal : Identify what you want to achieve by trading cryptocurrencies, such as long -term growth or short -term profits.

- Set clear targets and strategies of risk management : Set the rules for investing and risk management, including degrees restrictions and position size.

3.

- Analyze data and identify patterns : Look for correlation between various variables, such as price movements, rotation volume and market moods.

- Rate investment options : Compare different cryptocurrencies and determine which of them have the greatest growth or profit potential.

- Create a trade plan

: Based on your research, create a trade plan that outlines your strategy, risk management approach and entry/output criteria.

best practices

To ensure successful market research in cryptocurrency trading, follow the best practices:

- Be on a regular basis with the latest news and trends : market research is as good as collected information.

2.

Leave a Reply