Market Psychology: How Binance Coet (BNB) affects business strategies

Cryptomas have long been known for their high volatility and unpredictability, making it difficult to determine prices. One player, however, turned out to be a significant force in the formation of market psychology – the cryptocurrency itself, its basic value, binance coins (BNB). In this article, we will check how BNB affects business strategies and why investors should consider taking into account navigation in crypt.

What is market psychology?

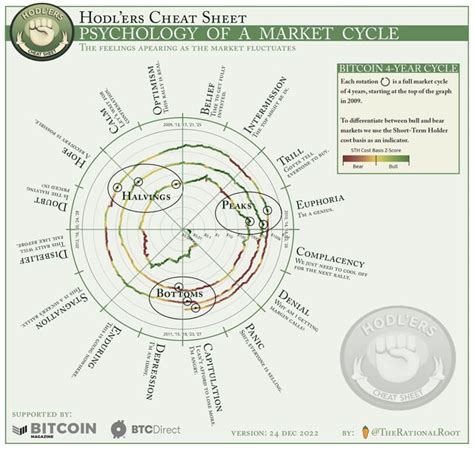

Market psychology refers to a study on how emotions and psychological factors affect investor behavior in the financial markets. This includes a variety of aspects, including risk tolerance, emotional decision -making and herd behavior. In the context of the cryptography market, market psychology plays a crucial role in developing prices and commercial strategies.

Binan Coins (BNB) increase

Binance Coin is the original binance of the popular cryptocurrency exchange, one of the largest cryptocurrency platforms in the world. BNB, launched in July 2017, was designed to motivate users to participate in the Binance ecosystem using a reward program that offered discounts on business fees and other benefits.

The success of the binance coin can be attributed to its unique features:

1.

- ** Tobble Base Marker: Unlike some other cryptocurrencies that focus only on speculation, BNB is a usefulness in the real world, such as discounts on business fees that apply to users who want to reduce their costs.

3

High liquidity

: Binance coin has a high level of liquidity that facilitates trade and transfer to other assets.

Market Psychology Impact

There are several ways to see the impact of BNB on market psychology:

1.

- Bias confirmation : Investors who have already purchased or sold BNB are probably more likely to take their positions to confirm where they interpret market movements as strong trend evidence.

3

Emotional Decision -Note : Crypt market volatility and uncertainty can lead to emotional decisions, such as buying or selling panic when prices seem to fall suddenly.

Trade strategies

Traders should consider such effective navigation strategies in crypt markets for BNB:

1.

- Stop orders : Use commands to lose stop to limit the potential loss when BNB falls below a certain price level.

3

consistent size position

: Carefully manage position size to avoid excessive risk based on emotional decisions.

- Market Mood Analysis : Supervise the market mood and adjust the commercial strategies accordingly, taking into account the impact of high functions and chips based on BNB utilities.

Conclusion

BNB has become an important player, developing market psychology in cryptocurrency markets. Its unique features and decentralized management system have created an environment that attracts investors looking for usefulness in the real world and attractive compensation. In order to effectively navigate these markets, merchants need to consider psychological factors affecting investor behavior when deciding to trade. In this way, they can optimize their strategies to reduce risks and increase return.

Leave a Reply