Impact of risk assessment on Monero trade (XMR): key factors for cryptocurrency investors

Cryptocurrencies, including Monero (XMR), have had significant growth and variability over the past decade. As a result, investors were bombed with numerous trade strategies and investment capabilities on this rapidly developing market. One of the key aspects that should be taken into account in the XMR trade is the risk assessment – the process of assessing potential risks and awards related to the investment. In this article, we will delve into the importance of risk assessment in Monero trade (XMR) and examine how this can affect your investment decisions.

why the risk assessment matters

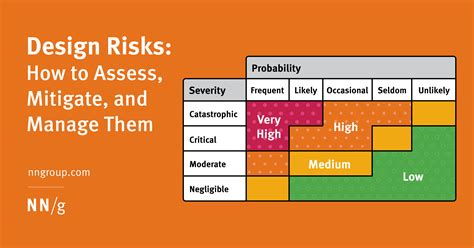

Risk assessment is not only a theoretical concept; This is a key aspect of successful investment of cryptocurrencies. By investing in XMR or other cryptocurrency, you are exposed to different risk that can cause significant losses. These risks include:

- price variability : cryptocurrencies such as Monero (XMR) Experience quick price fluctuations due to market moods and speculation.

- Risk of liquidity

: Trade on cryptocurrency stock exchanges may be unstable, which leads to problems with liquidity and potential losses if you are unable to sell coins quickly or at a favorable price.

- Risk of security : Exchange of cryptocurrencies and wallets often do not have adequate security measures, which makes it easier for hackers to steal funds.

- Adjusting risk : changes in regulations and provisions regarding cryptocurrencies may affect the value of XMR or other assets.

Understanding risk assessment

Risk assessment is an important part of the monero trade (XMR). It includes the assessment of various factors that can affect the price of cryptocurrency, including:

- Supply and demand : The balance between the number of coins available and the buyer interest can significantly affect prices.

- Market sentiment : Investors’ emotions such as fear, greed or euphoria may increase price movements.

- Network effects : Decentralized Monero network and strong safety functions contribute to its acceptance indicator.

- Competition : XMR faces competition from other cryptocurrencies that may affect its market share.

Risk assessment strategies

To reduce the risk during XMR trade, investors must be aware of the following strategies:

- position size : Specify your risk tolerance and adjust the size of the position to reduce potential losses accordingly.

- Orders for stopping : Set the Stop-Loss order to automatically sell coins if they fall below a certain price level.

3.

- Regular monitoring : Continuous monitoring of XMR prices, market moods and commercial activities to make informed decisions.

The best risk assessment practices

To ensure an effective risk assessment during Monero trade (XMR), consider the following best practices:

- Use a technical analysis : Analyze charts and patterns to identify potential trends and risk.

2.

- Set clear goals : Define your investment goals and risk tolerance before starting a commercial trip.

- Keep Records

: Monitor your transactions, including losses, profits and any significant events.

Application

Risk assessment is a key aspect of Monero (XMR) or other cryptocurrency trade. Understanding the potential risk associated with XMR and implementing effective risk management strategies, you can minimize losses and maximize your phrases on this rapidly developing market. Remember to stay up to date, set clear goals and constantly monitor your transactions to make informed decisions.

Leave a Reply