The Impact of Social Media on Cryptocurrency Prices

In the past few years, cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) have experienced significant price fluctuations. These fluctuations can be attributed to a variety of factors, including market trends, investor sentiment, and regulatory changes. One factor that has gained significant attention in recent times is social media. In this article, we will explore the impact of social media on cryptocurrency prices.

What is Social Media?

Social media refers to online platforms such as Twitter, Facebook, Instagram, and YouTube where users can share information, ideas, and content with a large audience. Social media has become an essential part of modern life, with billions of people around the world using these platforms to connect with others, express themselves, and stay informed about current events.

How does Social Media Affect Cryptocurrency Prices?

Social media plays a significant role in influencing cryptocurrency prices for several reasons:

- Price Prediction Algorithms: Many social media platforms use algorithms that analyze market trends, sentiment, and economic data to predict future price movements. These algorithms can provide predictions based on user-generated content, such as tweets, posts, and comments.

- Market Sentiment

: Social media platforms allow users to express their opinions and emotions about a particular cryptocurrency or market trend. Positive sentiments, such as excitement and optimism, can drive up prices, while negative sentiments, such as fear and pessimism, can lead to price drops.

- Investor Behavior: Social media can also influence investor behavior, with some users using platforms like Twitter to buy or sell cryptocurrencies based on news, trends, or market analysis.

- Market Microcapsulation: Social media can create a “market microcapsulation” effect, where small changes in price are amplified and made more visible to the public. This can lead to rapid price movements and make it easier for investors to speculate on markets.

Examples of Social Media Influencing Cryptocurrency Prices

Several examples demonstrate how social media has affected cryptocurrency prices:

- Bitcoin (BTC): In 2018, a tweet from Elon Musk, CEO of Tesla and SpaceX, sparked a massive increase in Bitcoin’s price by around $10,000. Musk’s subsequent tweets about his enthusiasm for the cryptocurrency further fueled its price rise.

- Ethereum (ETH): In June 2020, a Twitter thread by Ryan Seacrest, host of E! News, suggested that Ethereum might be due for a price increase. The thread was followed by many replies and comments from investors and market analysts, who believed that the tweet had significant influence on the cryptocurrency’s price.

- Litecoin (LTC): In 2020, a Twitter poll by cryptocurrency analyst Anthony “Gus” Green raised concerns about the safety of the cryptocurrency after it experienced a massive price drop. The poll asked users whether they believed LTC was safe to hold or sell, with over 30% of respondents supporting selling.

Challenges and Limitations

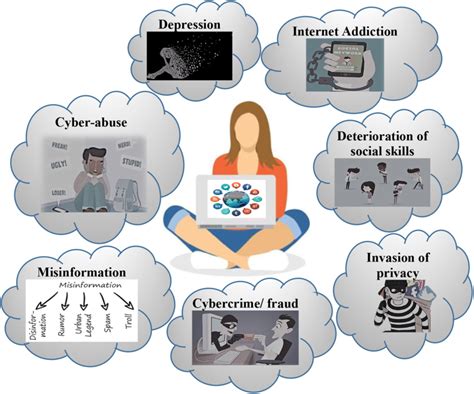

While social media can have a significant impact on cryptocurrency prices, there are also challenges and limitations to consider:

- Fake News

: Social media platforms can be prone to fake news and misinformation, which can lead to price manipulation and instability.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving, which can create uncertainty and volatility in market prices.

- Market Manipulation: Social media platforms are not immune to market manipulation, where individuals or groups can artificially influence prices through fake news, spamming, or other means.

Conclusion

In conclusion, social media has become an increasingly important factor in shaping cryptocurrency prices.

Leave a Reply