Understanding of market signals: How Tether (USDT) influences the trade

The world of cryptocurrencies is a constantly developing and dynamic market. As a new altcoin, traditional activities such as Bitcoin and Ethereum are increasing and are aimed at the feeling of the market. Two companies that have attracted considerable attention in recent years are a Tether (USDT), a stable coin that is anchored to the USA and Bitcoin Dollar (BTC), the largest cryptocurrency after market capitalization.

Tether is a digital currency published by Tether Limited, a company based in Gibraltar. The activity was widespread as a reserve currency for dealers, institutions and countries around the world. However, the influence on trade can be more complex than it seems. In this article we will deepen the way Tether (USDT) influences trade and examines both the positive and the negative aspects of its effects.

What is Tether?

Tether (USDT) is a stable coin that is anchored on the US dollar. This means that a USDT unit has a steady relationship with the value of the US dollar. The stability of this PEG is guaranteed that the value of the USDT cannot flow excessively from its basic value, which is 1 bond for US dollar.

Positive influences:

The influence of Tether on the trade can be seen in different areas:

! This makes it easier for you to navigate in the complex panorama of cryptocurrency without worrying about considerable price difficulties.

* Increase in adoption:

The widespread introduction of Tether has increased the credibility of the cryptocurrencies between institutional investors and end users. This in turn contributed to a more stable and more resistant cryptocurrency market.

* Sime -integration: The Tether stability facilitates the integration of cryptocurrencies into traditional financial systems. It facilitates banks, brokers and other institutions to offer cryptocurrency services that can help increase acceptance.

Negative influences:

However, there are also several negative aspects to be taken into account:

* Price manipulation: The perception of Tether (USDT) of the market has caused some dealers to take advantage of their stability and to influence the movements of cryptocurrency prices. If the prices in the expectation of an event listed by StableCoin such as an advertisement by the central bank or a change in the official interest rate can be carried out up to the cryptocurrency markets by an important financial institution.

* Competition: The growing adoption and visibility of Tether (USDT) has created a competition for other stable coin than Cava, USD coin (USDI) and others. This competition can lead to price wars that can have a negative impact on the feeling and the overall market prices.

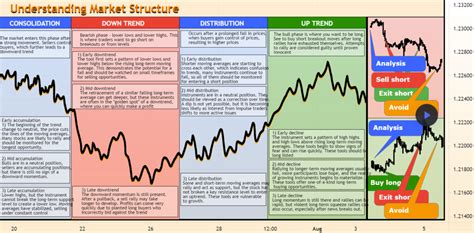

Marking signals:

To get a deeper understanding of how Tether (USDT) influences trade, we examine some market signals:

* Tether’s offer: The circulation of the bond plays an important role in determining the market value. If the supply is high, it can lead to an increase in demand and prices.

* Correlation of Bitcoin-Tether: The correlation between Bitcoin (BTC) and USDT was an important factor in determining their price movements. If there is great price fluctuations in a company, it often affects the other.

* Institutional feeling: The feeling of institutional investors compared to stable coins can have a significant impact on market prices.

Diploma:

The influence of Tother on the trade is diverse and complex. While its stability has increased the acceptance and credibility between the dealers, it also creates competition for other stable coin and can lead to manipulation of prices if they are not managed correctly. By understanding the factors that Tether (USDT) and their interaction with other cryptocurrencies influence, investors can make more informed decisions about their investment strategies.

Advice:

1.

Leave a Reply