The meaning of bitcoin cash (BCH) for volatility and market analysis

In the world of crypto currency, the market volatility is a common phenomenon that can affect the value of different digital assets. Among the numerous available crypto currencies, some were more unstable than others. Two such crypto currencies that have attracted significant attention are Bitcoin (BTC) and Ethereum (ETH). However, the Crypto currency managed to get its own niche in this area: Bitcoin Cash (BCH).

In this article, we will deal with the important BCH for the volatility of the market and analyze their historical effect, technical indicators and future prospects.

What is Bitcoin Cash?

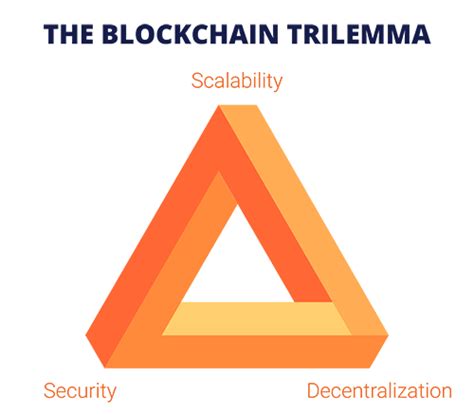

Bitcoin Cash is a digital currency peer-to-peer that was created as an alternative to Bitcoin. Although Bitcoin is designed as a decentralized, open and safe cryptocurrency, Bitcoin Cash is introduced to address some restrictions on the original Bitcoin protocol. BCH aims to offer more flexibility in terms of its applications, scalability and users.

The market volatility

The market volatility of Bitcoin was the topic of discussion between investors and analysts. The cryptocurrency market is known for its high degree of uncertainty, with prices quickly fluctuating in response to various factors such as global economic conditions, regulatory changes and moods.

In recent years, the volatility of the Bitcoin market has increased significantly, with prices fluctuations over 10% or more recorded several days. This volatility can be attributed to different factors, including:

- Global economic uncertainty : economic swings, recessions and trade wars led to a decrease in trust and price of investors.

- Regulatory changes : Governments around the world have been conducted by regulations that limit certain activities regarding the cryptocurrencies, leading to increased volatility.

3

Bitcoin Cash could because of his:

- Increased adoption : Cases of login and adoption of BCH -A have increased significantly and offer greater demand for a cryptic currency.

- Improved scalability : BCHS larger block size and faster transaction processing time make it more suitable for nets with high traces.

Analysis

In order to analyze the volatility of the market and the potential future prospect of BCH, we will examine several technical indicators:

- Price ratio and O-OD-Toferlay (p/e) : This relationship helps us determine whether the curine currency is overrated or underestimated in relation to your income.

- Mobile average values : These technical indicators help recognize trends and prediction of price movement.

- Relative strength index (RSI)

: This indicator measures the rate of change in price in relation to the previous prices and shows overpowered or excessive conditions.

BCHS Historical performance

Here’s a brief overview of the historical performance of BCH:

* 2017 : The year where it all started for BCH was 2017. After the initial hyper of bitcoin, the price of BCH -A exponentially increased.

* 2020 : After the goal of the Coidida 19 pandemic, the BCHS Price recorded a significant decline due to the reduced interests of investors.

Technical indicators

Here are some technical indicators for BCH:

- Price and play ratio (p/p) : This ratio compares the current price of the CRIPTO currency with payment fees for payment.

- A moving average converge divergence (MACD) : This indicator helps to recognize trends and prediction of price movement.

future prospects

If we look at the future, it is important to consider potential risks and rewards associated with investment in BCH:

1.

Leave a Reply