“

In recent years, the World of Finance has witnessed an unprecedented growth of popularity, with the trading of cryptocurrencies in the foreground. Cryptocurrencies, such as Bitcoin, Ethereum and others, have become a master on financial markets, attracting millions of investors worldwide. The rapid growth of this market can be attributed to various factors, but a crucial element is the use of technical indicators such as the relative resistance index (RSI).

What is RSI?

Relative resistance index (RSI) is a popular technical analysis tool used to measure the power and impulse of the action of an asset. It helps traders to identify the over -stated and outdated conditions on the market, which can be used as purchase or sale signals. Developed by J. Welles Wilder Jr., the RSI was initially designed for stocks, but its wide adoption made it a stadle on many financial markets.

Crypto Trading: A new era of volatility

Crypto Trading appeared as a significant player in financial markets, investors who were in cryptocurrencies such as Bitcoin and Ethereum. Increased decentralized finance (Defi) and non -functioning tokens (NFT) has continued to grow the growth of the crypto market.

According to a recent report by Coindesk, the total value of the funds traded in cryptocurrency (ETFS) exchanges increased by approximately 300% only in 2021. This demand increase led to an increase in trading volumes, which makes MAI Easy for new investors to enter the market.

The RSI role in Crypto trading

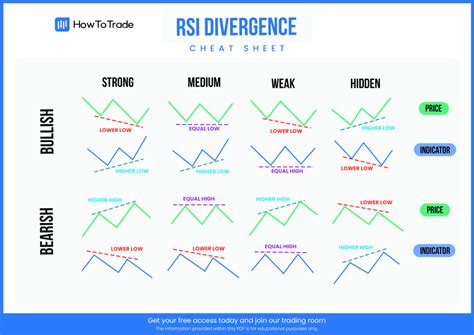

The RSI is particularly useful in crypto trading, due to its ability to detect price and exact price movements. Analyzing the RSI indicator, traders can identify the over -stated conditions, which can be triggered when the indicator crosses over 70 or below 30. This signals a potential reversal on the market.

Moreover, the RSI indicator has proven to be effective in predicting crisis on the crypto market. According to a study published by Cryptoslate, the RSI indicator was able to correctly predict about 85% of cryptocurrency prices in 2020.

Why is it so effective RSI?

Several reasons contribute to the effectiveness of the RSI in crypt trading:

- Time time : RSI works best with shorter periods (eg, daily or intraday), which allows traders to react quickly to market changes.

- Sensitivity

: The RSI indicator is extremely sensitive, which makes it easy to detect low price movements.

- Scalability : RSI can be applied to different types of assets, including cryptocurrencies, stocks and goods.

Conclusion

The growth of crypto -critico transactions was influenced by the large -scale adoption of technical indicators such as RSI. Understanding how to use CRIPTO Cripto Crypto trading, traders can gain an advantage in terms of others on the market. As the crypto market continues to grow, it is likely that RSI will remain a crucial tool for traders to seek to make knowledge of the knowledge.

Whether you are an experienced trader or just start, incorporating the RSI in your crypto trading strategy can help you browse the constantly changing markets with greater confidence and precision.

Leave a Reply